Increasing Financial Resilience and Tackling Climate Change!!

Want to know the climate risk of a particular geography?

According to the Food and Agriculture Organization of the United Nations, the global cost of extreme weather events on agriculture is estimated to be around $10-15 billion per year.

Who do we serve?

These weather events impact stakeholders in the entire value chain.

AgriTechs

- To secure supply chain losses

- To scale in new markets

- Generate alternate source of revenue with enhance value-added services

FnB & Ingredient Companies

- To secure your supply chain management

- Deliver impactful sustainability projects

Input Companies

- To provide better assurance to farmers, Improve customer retention

- Strengthen market positioning

Insurance & Reinsurance Companies

- To streamline and optimize satellite data management

- Expedite new product development with tailor-made risk modelling platform

Government & Development Agencies

- To facilitate financial resilience to farmers with efficient program implementation

- Easier and faster scaling options in new geographies

Financial Institutions

- To provide credit guarantee along with loans and secure default risk due to weather-related event

- Increase loan portfolio; Better loan pricing

Farmer Cooperatives or Farmers

- To provide more liquidity

- Get better credit options; Build trust among stakeholders

Dairy

- To establish better relations with dairy farmers; Secure supply chain management

- Build dairy farmer’s resilience

What is the solution?

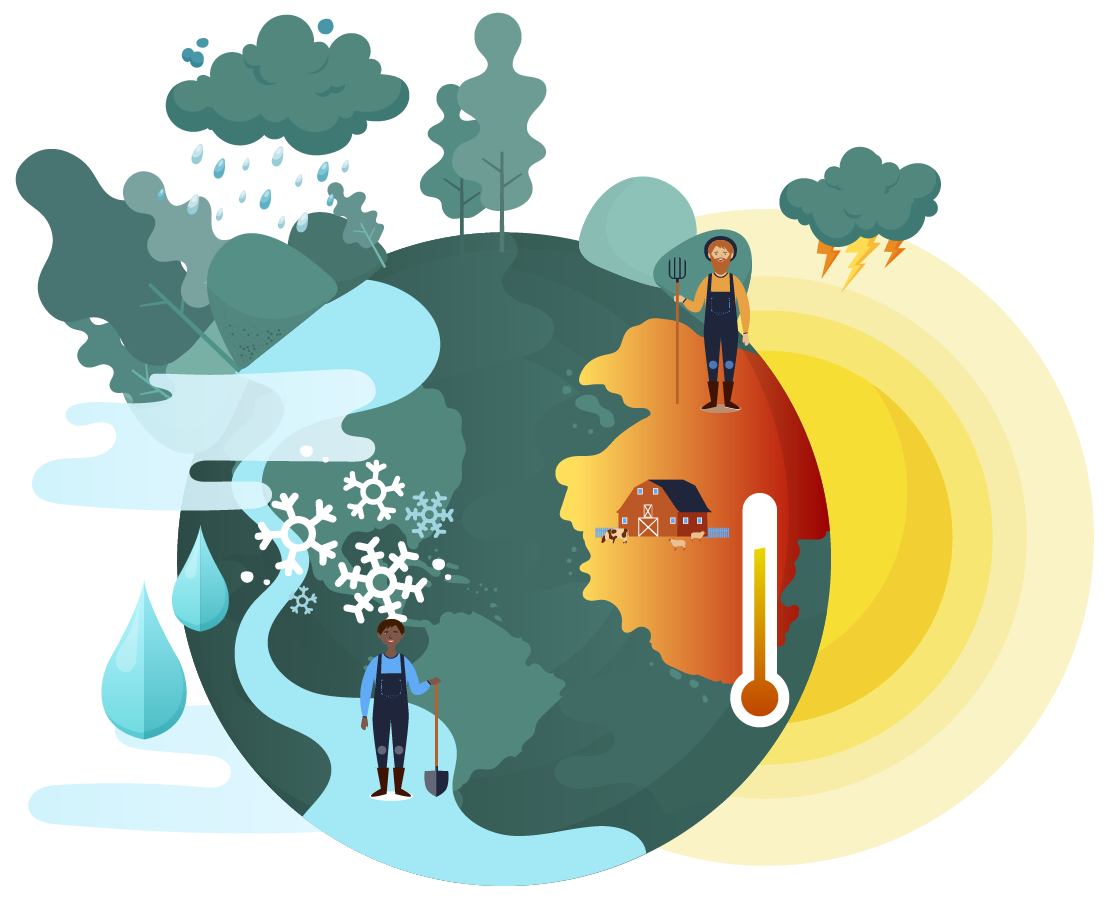

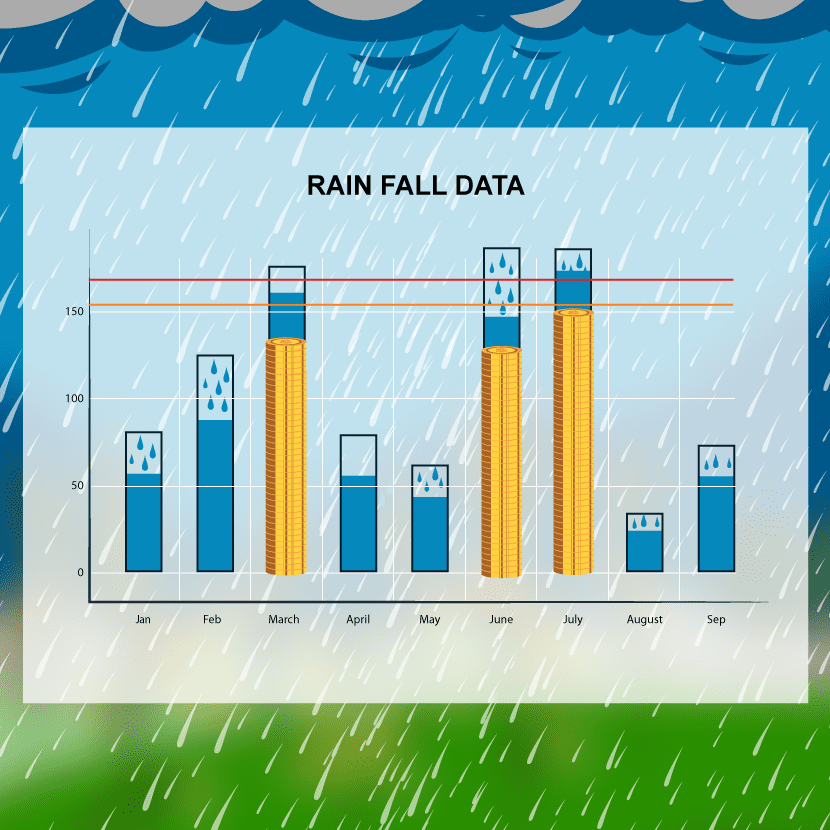

IBISA designs index-based insurance solutions to cater the customers that get affected by climate change or weather-related risks like:

- Excess Rainfall

- Cyclone or Typhoon

- Lack of Rainfall

- Extreme temperature

Our USPs:

- Cost-effective

- Faster Payouts

- No manual claim filing

- Tailor-made Products

Our USPs:

- Cost-effective

- Faster Payouts

- No manual claim filing

- Tailor-made Products

Custom onboarding applications make it easier to onboard policy holders and integrate them via APIs.

Policy Management System makes is easier to operate policies and do claim management.

Multi-level platform access for increasing transparency to the process.

Risk modelling tools and dashboards to facilitate the explanation of insurance products for awareness.

Want to know the climate risk of a particular geography?

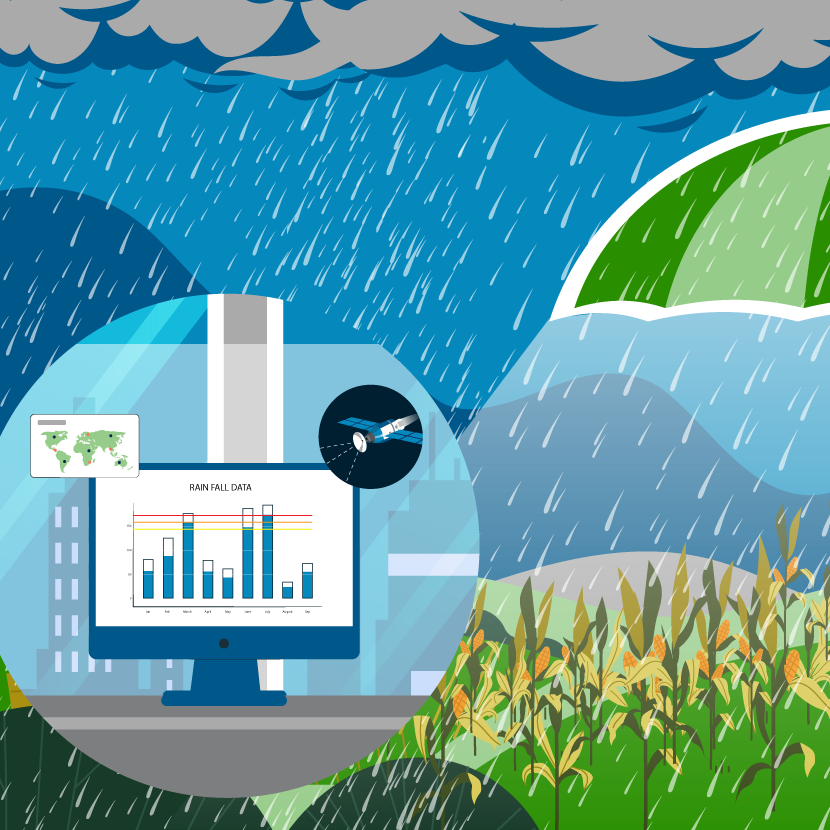

How does it work?

Designing a tailor-made index-based insurance product has never been this easy.

Step 1

Define the locations and weather risks

We would analyze relevant weather data of the selected locations and do a preliminary definition of triggers for the weather risks.

Step 2

Select the parameters of your choice

What kind of triggers would be relevant for the geography? Don’t worry if you do not know this! With our tools, we’ll demonstrate how a product would payout.

Step 3

Receive the claims automatically

Once a trigger has reached or crossed the threshold value, we will analyze the satellite data and claim payout process would initiate within 10 days of the occurrence of a weather-event.

Solutions with Global Reach!

The SCALABILITY of IBISA’s solution design to newer markets has allowed us to operate in 4 different continents with different projects in Philippines, India, New Zealand, Guatemala, and West Africa.

Guatemala

In light of the Cop27 summit, new challenges have unfolded before the world economies. But the question remains, are we prepared for the impacts of climate change? In partnership with the World Food Programme and other local insurers, IBISA is designing a forecast insurance index that can be used by government agencies to release funds in advance to affected areas.

Thus, mobilizing farmers or take necessary actions to minimize the loss via advance measures instead of money spent on post-damage control measures..

Senegal

To cope with the ever-increasing climatic risks and to preserve vital income for pastoralists, IBISA has joined forces with CNAAS and RBM, with the support of ADA, to set up tailor-made parametric insurance in Senegal.

By deploying this pastoral insurance to pastoralists in Senegal, the long-term objective is to establish and secure the insurance product value chain between IBISA (product designer and platform), RBM (in charge of distribution), CNAAS (the policyholder), and the reinsurer. After a successful first pilot project, the project in its second version has just been launched.

Niger

This is the first IBISA project for breeders and pastoralist where we developed with local partners solutions to cover a particular moment of the year, called “soudure”, when animals can suffer from lack of vegetation and biomass to wait until the next rain season.

In this case, breeders could need to get rid of some animals or pastoralist to move longer and further during the “transhumance” period. This longest and more remote move to pasture creates tension with local populations. Thus, covering them is reducing climate conflict risks.

Ghana

Coming soon

Madagascar

For Food, Beverage and Ingredient companies, we realized an analysis on the relation between tropical crops, weather condition and satellite data, in order to anticipate months in advance a potential supply tension with simple, actionable, and measurable metrics.Kenya

Coming soon

India

Given the diverse geo-climatic conditions of India, a one-size-fits-all strategy will not work! We strive to provide climate insurance solutions with flexible boarding dates and coverage duration options for lack of rainfall, excess rainfall, and vegetation index.

We equip small holder farmers with these insights in the southern states of India at a micro-level.

The Philippines

Typhoons hit various regions of the Philippines 16 times a year on average. With the help of our innovative tools, we have designed solutions that help (protect against/model risk of/etc. ) wind speed and rainfall that wreak havoc on crops cultivated in those regions.

We partner with local insurance providers, allowing farmers of the Philippines to receive compensation within 10 days of the calamity. This was through meso-level coverage for the different provinces.

New Zeland

The frequency and intensity of droughts, extreme rainfall events, is affecting pasture growth, livestock health and their productivity.

IBISA has studied the effects of excess wind speed in one of the regions of New Zealand and is working to develop excess rainfall solutions for the other parts of New Zealand.

The insurance cover then designed could either be used for a dry run or could be actually implemented on the beneficiaries of the cover.

Malaysia

Similar to Madagascar analysis, we studied the correlation between tropical crops, weather condition and satellite data.

This lead to risk assessment of the supply of those resources according to risk concentration / diversification criteria. Meaning, what are the main perils for those crops, how are they geographically distributed and correlated, and ultimately how to better diversify supply regarding weather and climate risks.

- Active insurance projects

- Analysis and studies

- Projects coming soon

In light of the Cop27 summit, new challenges have unfolded before the world economies. But the question remains, are we prepared for the impacts of climate change? In partnership with the World Food Programme and other local insurers, IBISA is designing a forecast insurance index that can be used by government agencies to release funds in advance to affected areas.

Thus, mobilizing farmers or take necessary actions to minimize the loss via advance measures instead of money spent on post-damage control measures..

To cope with the ever-increasing climatic risks and to preserve vital income for pastoralists, IBISA has joined forces with CNAAS and RBM, with the support of ADA, to set up tailor-made parametric insurance in Senegal.

By deploying this pastoral insurance to pastoralists in Senegal, the long-term objective is to establish and secure the insurance product value chain between IBISA (product designer and platform), RBM (in charge of distribution), CNAAS (the policyholder), and the reinsurer. After a successful first pilot project, the project in its second version has just been launched.

Coming soon

This is the first IBISA project for breeders and pastoralist where we developed with local partners solutions to cover a particular moment of the year, called “soudure”, when animals can suffer from lack of vegetation and biomass to wait until the next rain season.

In this case, breeders could need to get rid of some animals or pastoralist to move longer and further during the “transhumance” period. This longest and more remote move to pasture creates tension with local populations. Thus, covering them is reducing climate conflict risks.

For Food, Beverage and Ingredient companies, we realized an analysis on the relation between tropical crops, weather condition and satellite data, in order to anticipate months in advance a potential supply tension with simple, actionable, and measurable metrics.

Given the diverse geo-climatic conditions of India, a one-size-fits-all strategy will not work! We strive to provide climate insurance solutions with flexible boarding dates and coverage duration options for lack of rainfall, excess rainfall, and vegetation index.

We equip small holder farmers with these insights in the southern states of India at a micro-level.

Similar to Madagascar analysis, we studied the correlation between tropical crops, weather condition and satellite data.

This lead to risk assessment of the supply of those resources according to risk concentration / diversification criteria. Meaning, what are the main perils for those crops, how are they geographically distributed and correlated, and ultimately how to better diversify supply regarding weather and climate risks.

The frequency and intensity of droughts, extreme rainfall events, is affecting pasture growth, livestock health and their productivity.

IBISA has studied the effects of excess wind speed in one of the regions of New Zealand and is working to develop excess rainfall solutions for the other parts of New Zealand.

The insurance cover then designed could either be used for a dry run or could be actually implemented on the beneficiaries of the cover.

IBISA is proud to contribute to the following 5 SDGs from UNDP:

Testimonials

They trust us and it is our responsibility to maintain this trust!

Our partners